Ahmed Ali Mohammad

27

SBE, Vol.20, No.1, 2017

ISSN 1818-1228

©Copyright 2017/College of Business and Economics,

Qatar University

and Tsai, 2012). It is widely accepted that, the

efficient and intensive use of knowledge

technologies to track manufacturing process,

inventory, and sales opportunities has replaced

physical assets by the organizational assets. As

a consequence, knowledge companies have

been reduced in terms of size and staff (Boulton,

2000). The above realities reflect the

imperatives of the technology approach to

construct knowledge accounting. These

imperatives entail new paradigms for managing

and measuring the financial statements. This

new approach is not surprising since the

technology has disrupted the traditional

philosophy of accounting. To strengthen and

being highly influential in knowledge discipline

of business, the technology approach has

extended to construct knowledge income

statement (Blaug and Lekhi, 2009). The

technology income assumes that the different

stages of technical readiness shape the

uncertainty and future profit of knowledge

companies. The growing challenges of

knowledge technologies provide real drivers

for the improvement and growth of each item

of income statement (Martin and Leurent,

2017). This is valid for sales revenue, cost of

goods sold, and all sorts of expenses such as

research and development, selling, and

administrative expenses. The above differences

in accounting setting and the paradox related

has to be considered because its create conflict

that affect accounting information in terms of

reducing

reliability,

relevance,

and

understandability. To bridge the theory of

accounting to practices of knowledge

management, it is urgent to mention that

accounting information by its traditional

formats is no longer useful and relevant for

managing knowledge cash flows (Austin,

2007). The absence of knowledge assets

provides reasons for not using financial

statements by knowledge investors. The

technological management of balance sheet is

related to working capital and non-current

assets. The dramatic growth in knowledge

business has re-organized the priorities of

companies. The accounting assets are no longer

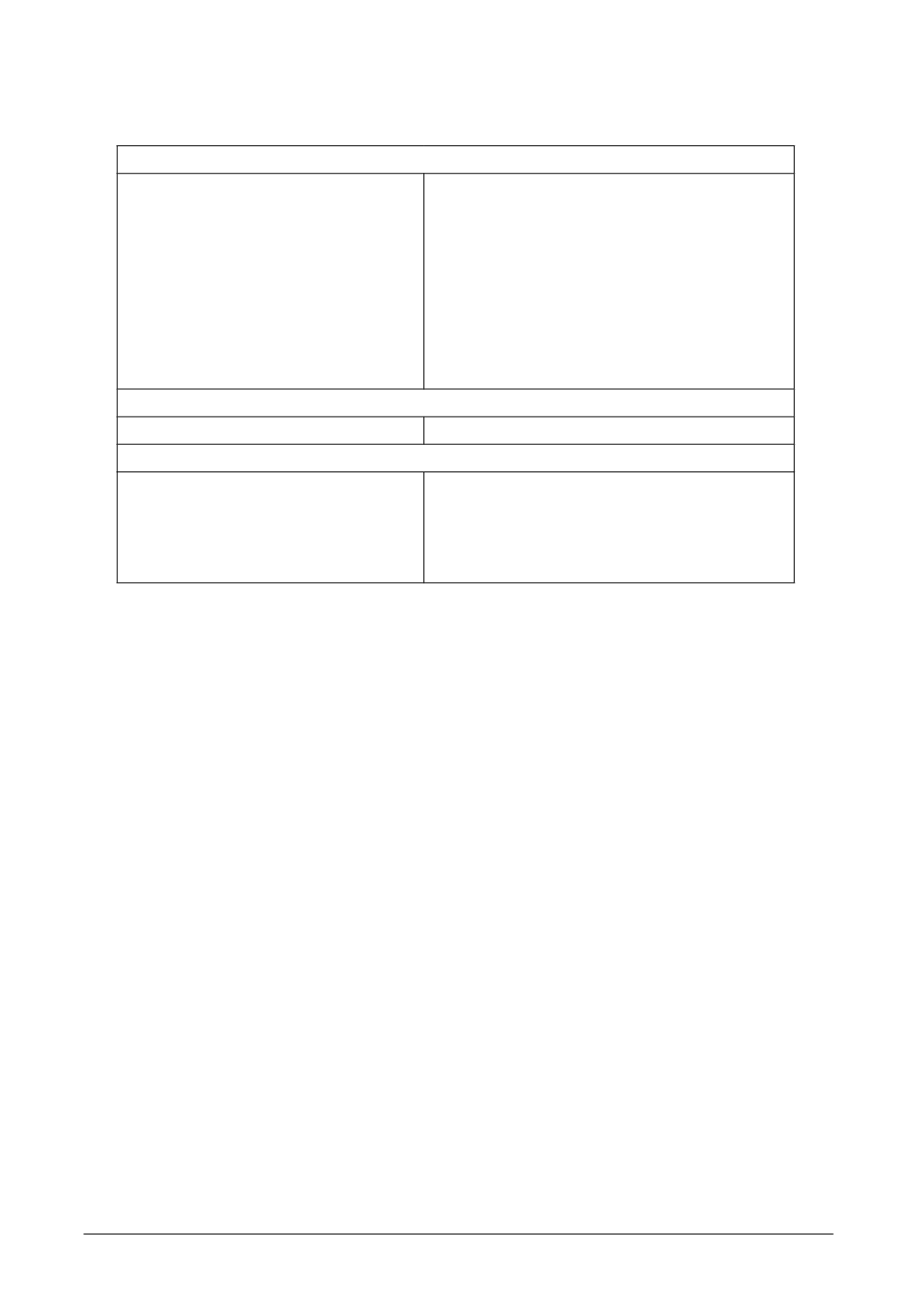

Table II: Financial Statement vs Knowledge Financial Statements

(Source: Stewart, 2001)

Income Statement vs. Knowledge Statement

Revenues

Cost of goods sold

Gross Margin

EBIT

Interest and Taxes

Net Income

Revenues

Innovation Cost

Customer Cost

Products/Services Cost

Administrative Costs

EBIT

Taxes

+/- None-cash adjustments

Cash earnings

Balance Sheet Equation vs. Knowledge Equation

Assets = Liabilities + Equities

Investments = Financing

Statement of Cash Flows vs. Knowledge Cash Flows

+/- Operating cash flows

+/- Investing cash flows

+/- Financing cash flows

Change in cash

Cash earnings

Investing cash flows

Free cash flows