Ahmed Ali Mohammad

25

SBE, Vol.20, No.1, 2017

ISSN 1818-1228

©Copyright 2017/College of Business and Economics,

Qatar University

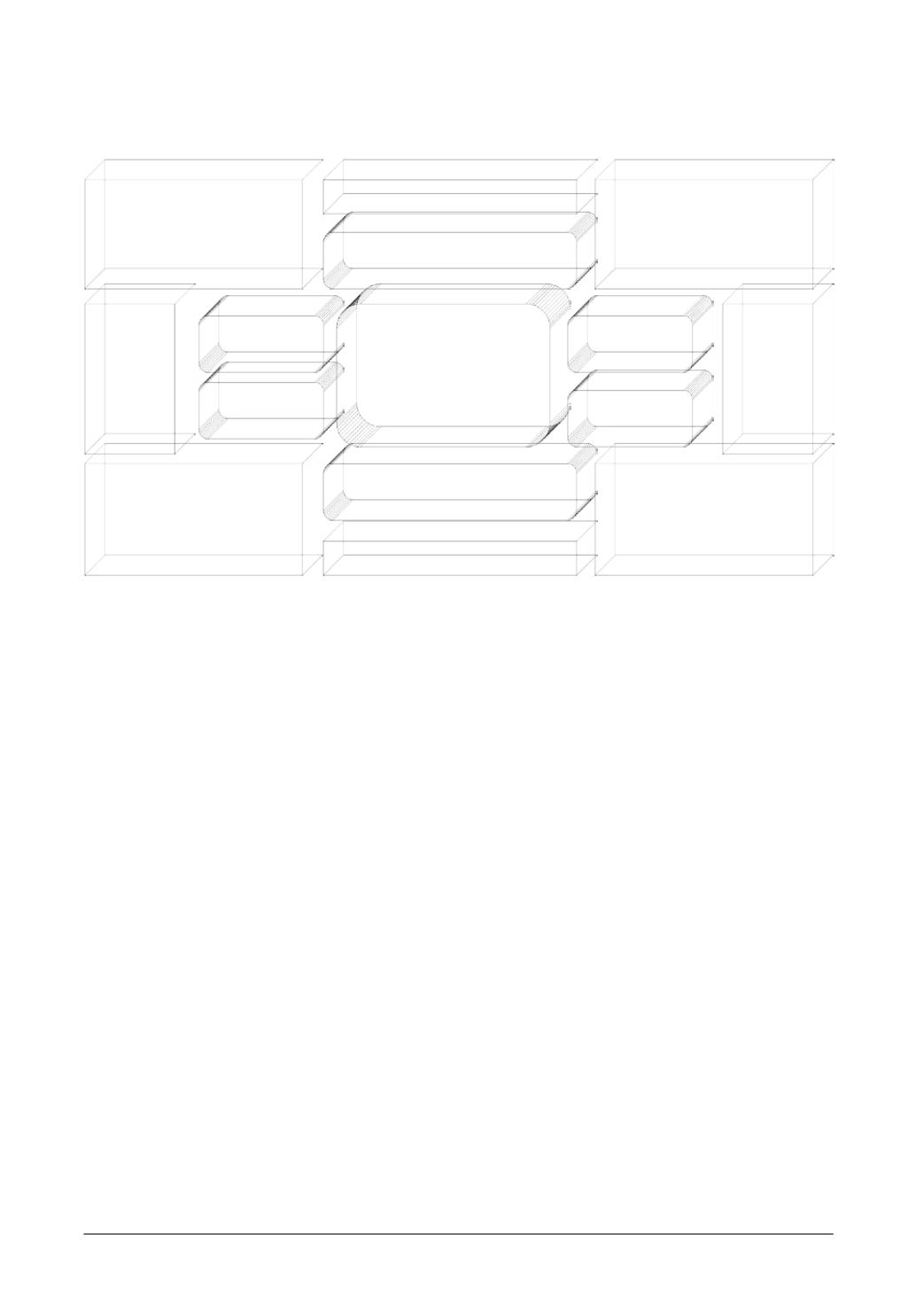

4.3 Re-structuring knowledge financial

statements

In order to present a birds’-eye view of the

problems of accounting against knowledge

management, the reporting formats of the

financial statements shall be considered. The

rigid reporting formats have fueled serious

critics against accounting for knowledge

management. The reporting formula of the

financial statements does not match the basic

assumptions of knowledge management. This

formula was valid under the assumptions of the

industrial management. The reality is that

financial statements don’t explicitly show any

technological content weather in the theoretical

philosophy or conceptual building block. As a

result, the reporting format of financial

statements is a data, backward, historical,

physical, monetary, actual, and operations

oriented. A major critic against accounting in

terms of technology is that the procedural rules

and standards have been theorized in isolation

of the technology. Fundamentally, these

realities reflect a deeper problem in the

theoretical assumptions and reporting structure

of accounting. The critical theorists think that

because of this logical lack, the accounting

model was always static, complex, unrealistic,

inefficient, and full of shortcomings. These

logical weaknesses have generated undesirable

consequences especially that related to

financial statements and the information

produced. In contrary, the emergence of

knowledge business model has dramatically

changed the way of doing business. This is

very reflected in knowledge management as

one of the key driving engines of this model.

Thus, this paradox has emerged from the great

gap in technology setting between accounting

for operations and accounting against

knowledge management. The meta-analysis of

the technological context of accounting has

identified a non-relationship between the

technology and the theoretical philosophy of

accounting (Hakansson

et al

., 2010). At this

point, accounting theory of operations is a

Knowledge

Revenue

Power

Knowledge Creation

Partnerships

Innovation Process

Customer Satisfaction

Updating

Conversion

Integration

Commercialization

Integrated

Extended

Interactivity

Connectivity

Agile

Fluid

Figure-3: Architecture of Knowledge Revenue Power