Ahmed Ali Mohammad

15

SBE, Vol.20, No.1, 2017

ISSN 1818-1228

©Copyright 2017/College of Business and Economics,

Qatar University

proposed framework. The value is generated

by innovation (discovery) and enhanced by

the unique organizational designs or human

resources practices. Prusak 2001 identified

three major nexuses of knowledge assets:

discovery, organizational practices, and human

resources. These assets are performing in

an integrated triangle for the value creation,

updating, and commercialization. The unique

discovery is acting as an engine of innovation

process and updated by investment in research

and development (Amidon, 2003). Moreover,

brands as a major form of knowledge assets

are often created by a unique combination of

the innovation and organizational structure.

Finally, human resources practices are

generally identified as a communicator to

guarantee continuity of value creation and

survive of knowledge assets (Holsapple,

2003). Considerable research projects have

been managed (individually and by bodies)

to develop alternative accounting models that

overcome the lacks of accounting against

knowledge management. The key feature of

those models is that none of these developed

models in the accounting literature has

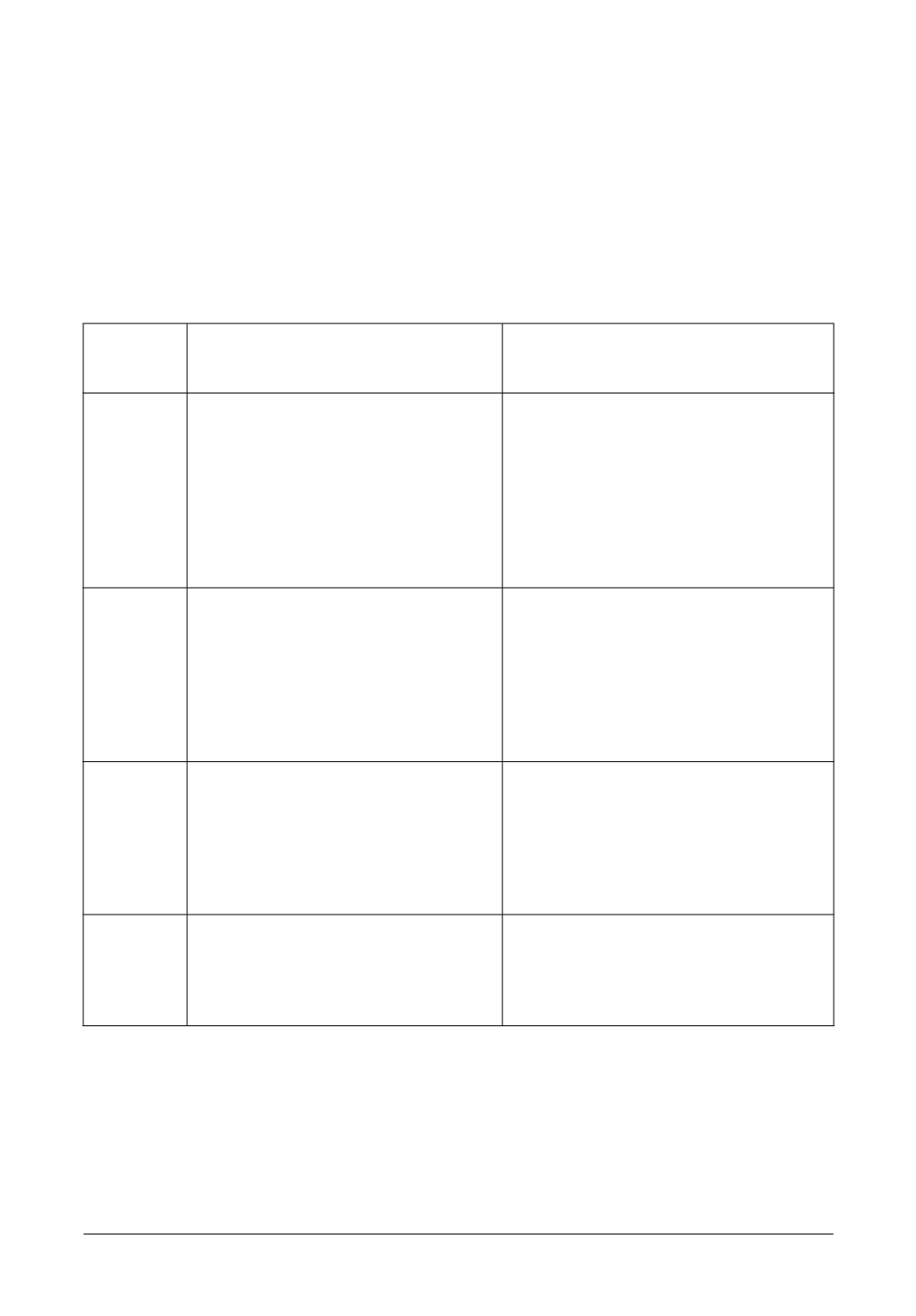

Table I: Accounting against knowledge vs. Accounting for operations

Accounting Against Knowledge

Accounting for Operations

Dynamic

Nature

ü

Knowledge System.

ü

Horizontal.

ü

Financial and non-financial.

ü

Relationships

ü

Inter.

ü

Integrated, cross-disciplinary, ad hoc,

fluid, and collaborative.

ü

Success in expanding relationships.

ü

Information System

ü

Vertical

ü

Financial

ü

Visible and physical activities.

ü

Intra.

ü

None integrated, closed, restricted, and has

boundaries of single businesses.

ü

Success in control.

Recognition

Rules

ü

Invisible flow of knowledge.

ü

Value Creation.

ü

Flexible, collaborative, and dynamic.

ü

Strategic.

ü

Comprehensive.

ü

Technical.

ü

Centered on knowledge.

ü

Physical flow of resources

ü

Value Realization.

ü

Rigid, isolated, and static.

ü

Operational.

ü

Financial.

ü

Procedural.

ü

Centered on data

Reporting

Power

ü

Focused on technology process.

ü

Supporting collaboration with business

partners.

ü

Networking.

ü

Extracted from e-business model.

ü

Reporting value.

ü

Focused on accounting process.

ü

Supporting performance of recording

and reporting process.

ü

Blocking

ü

Extracted from t-business model.

ü

Reporting cost.

Theoretical

Objectives

ü

Creating and sharing knowledge

ü

Value proposition matrix: balancing

performance, behavior, and

technology.

ü

Reporting Dynamic: Instant and online.

ü

Measuring profitability.

ü

Value proposition matrix: cost, time, and

quality.

ü

Reporting Dynamic: Periodical.