Meshari O. Al-Hajri

67

SBE, Vol.20, No.1, 2017

ISSN 1818-1228

©Copyright 2017/College of Business and Economics,

Qatar University

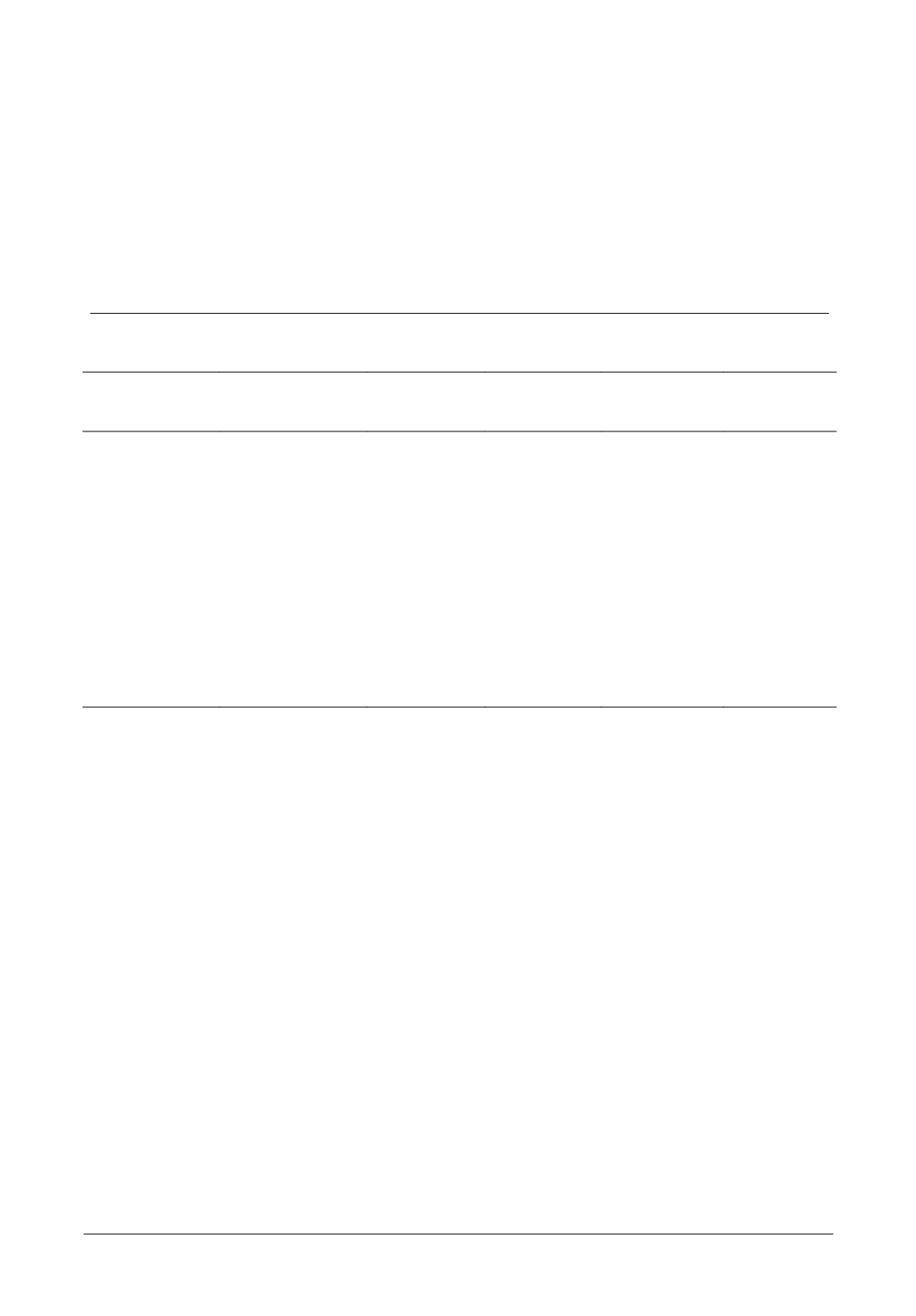

shown in Table 3, the regression coefficient

of the IA variable is statistically significant

(p-value < .057), and has the expected negative

sign. This result provides support to the

research hypothesis that IA contribution in the

external audit work would be associated with a

reduction in the amount of external audit fees.

As for the other independent variables, except

for the SIZE variable, the coefficients of the

control variables included in the researchmodel

are statistically insignificant. In particular, the

regression results show that the coefficient of

the SIZE variable is statistically significant

((p-value < .006) and has the predicted positive

FEE = b0 + b1 IA + b2 SIZE + b3 LOCAT + b4 QUICK + b5 LEVER + b6 ROA + b7 NAS

+ b8 BIG4 + b9 TENURE

Variable

Predicted Sign

Estimated

Coefficient

t

-statistic

p

-value

VIF

Intercept

4.001

3.252

0.003

IA

-

-0.007

-1.997

0.057*

1.383

SIZE

+

0.22

2.985

0.006***

1.878

LOCAT

+

0.408

0.865

0.396

1.184

QUICK

-

0.037

0.728

0.473

1.188

LEVER

+

0.376

0.685

0.499

1.83

ROA

-

-0.028

-1.009

0.323

1.382

NAS

?

0.507

1.473

0.153

1.118

BIG4

+

-0.135

-0.402

0.691

2.543

TENURE

-

0.156

0.863

0.396

2.123

Table 3. Regression Results

Regression summary statistics:

n = 35

R-square = .539

F-statistics =3.244

***, **, * p-value of statistical significance at the 0.01, 0.05, and 0.10 levels, respectively.

Note:

FEE : the natural log of total audit fees;

IA : External auditor’s assessment of the percentage of external audit work

performed by the audit client’s internal audit staff.

SIZE : the natural log of the audit client’s total assets;

LOCAT : the natural log of the number of audit locations visited by the audit team;

QUICK : the audit client’s current assets minus inventories to current liabilities;

LEVER : ratio of client’s total long-term debt to the total Assets.

ROA : ratio of the audit client’s net income to total assets.

NAS : a dummy variable, taking the value of one if the audit firm provides non-audit

services to the audit client, and zero otherwise.

BIG4 : a dummy variable taking the value of one if the audit firm is EY, PWC, KPMG,

or Deloitte.

TENURE : the number of years the audit client is continuously auditing the audit client.